On Wednesday, India’s lower house of parliament approved a groundbreaking online gaming bill, aiming to promote esports and casual gaming devoid of financial stakes. However, it introduces a comprehensive ban on real-money games, which could jeopardize billions of dollars in investments and lead to significant disruptions within the real-money gaming sector, potentially causing widespread closures.

The legislation, known as the Promotion and Regulation of Online Gaming Bill, 2025, seeks to outlaw real-money games across the nation, regardless of whether they are based on skill or chance. It also prohibits the advertising of these games and any related financial transactions, as reported by TechCrunch based on its draft.

India’s IT Minister, Ashwini Vaishnaw, emphasized the bill’s focus on societal welfare, stating, “Priority has been given to the welfare of society to prevent a growing evil that is infiltrating our community.”

The proposed law restricts banks and financial institutions from processing transactions related to real-money games. Offenders could face up to three years in prison and fines reaching ₹10 million (around $115,000). Celebrities endorsing such games might also face up to two years in jail or fines of ₹5 million (approximately $57,000), according to the bill.

Vaishnaw noted that the legislation was a response to various incidents of harm, including suicides linked to gambling losses. Yet, industry experts argue that these issues are primarily associated with offshore betting platforms, and the new law may not effectively address them.

Meghna Bal, director of the New Delhi-based think tank Esya Centre, criticized the legislation, stating, “This law is bound to face litigation as it undermines Article 19(1)(g) of the Constitution, which guarantees the right to pursue any profession or trade. Instead of protecting consumers, it dismantles compliant onshore businesses while inadvertently facilitating illegal offshore operations that pose the real financial risks.”

Ahead of the bill’s introduction, industry representatives urged Prime Minister Narendra Modi to intervene. A letter from the Federation of Indian Fantasy Sports and other gaming bodies warned that the legislation could inadvertently favor “illegal offshore gambling operations” while forcing Indian companies to shut down. These organizations represent major players like Dream Sports, MPL, and WinZO.

By stifling regulated Indian platforms, the bill may push millions of players towards illegal networks and unregulated gambling sites, the letter contended.

The combined enterprise valuation of India’s real-money gaming startups is estimated at ₹2 trillion (approximately $23 billion), generating revenues of ₹310 billion (around $3.6 billion) and contributing ₹200 billion (about $2.29 billion) annually in taxes. The industry anticipates a 28% annual growth rate, potentially doubling in size by 2028. However, the blanket ban could lead to over 200,000 job losses and the closure of more than 400 companies.

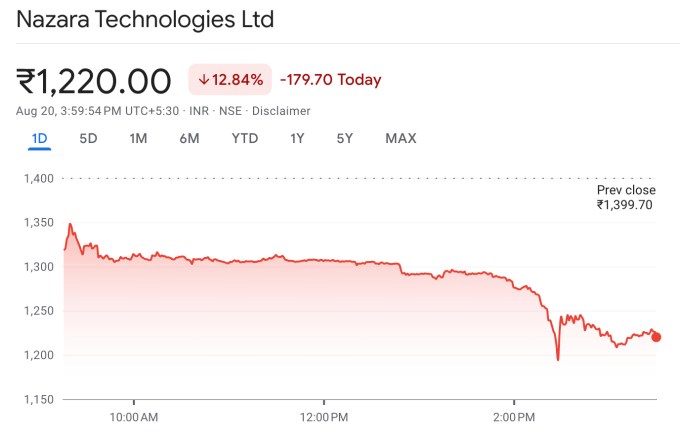

Publicly traded Nazara Technologies, which has invested in real-money gaming platforms, saw its share price drop by 12.84% following the bill’s announcement. However, the company clarified that it has “no direct exposure” to these businesses.

The bill passed swiftly in parliament, requiring only a voice vote within minutes of its introduction. It now awaits approval from the upper house and the president to become law.

In contrast, casual gaming and esports companies have expressed support for the legislation. Sumit Batheja, CEO of Ginger Games, remarked, “We commend this decision as it allows us to concentrate on business essentials—monetization, retention, and creating great IP for India and beyond, without confusion about our identity in the market.”

Krafton, the South Korean gaming giant behind PUBG, is backing this initiative.

Akshat Rathee, co-founder of NODWIN Gaming (partially owned by Nazara Technologies), highlighted the necessity for precise definitions in the bill to differentiate between esports, online gaming, and online money gaming, which is critical for clarity among stakeholders.

Bal added that the legislation could adversely affect esports, as a government body would determine the legitimacy of esports activities.

“This will have repercussions that extend beyond the realm of real-money gaming, impacting the entire ecosystem, including the AVGC [Animation, Visual Effects, Gaming, and Comics] sector,” she stated.

In 2023, the Indian government introduced a 28% tax on online gaming, leading to protests from industry stakeholders, with significant investors urging reconsideration of the tax. Although it remains in place, there are discussions about increasing it to 40% under new regulations.

Rohit Kumar, a founding partner at The Quantum Hub, criticized the abrupt nature of the new bill, suggesting that while regulation is necessary, sudden changes could damage India’s reputation as a stable investment environment.

We value your feedback! Help us improve TechCrunch’s coverage and events by participating in our survey. Your insights could win you a prize!